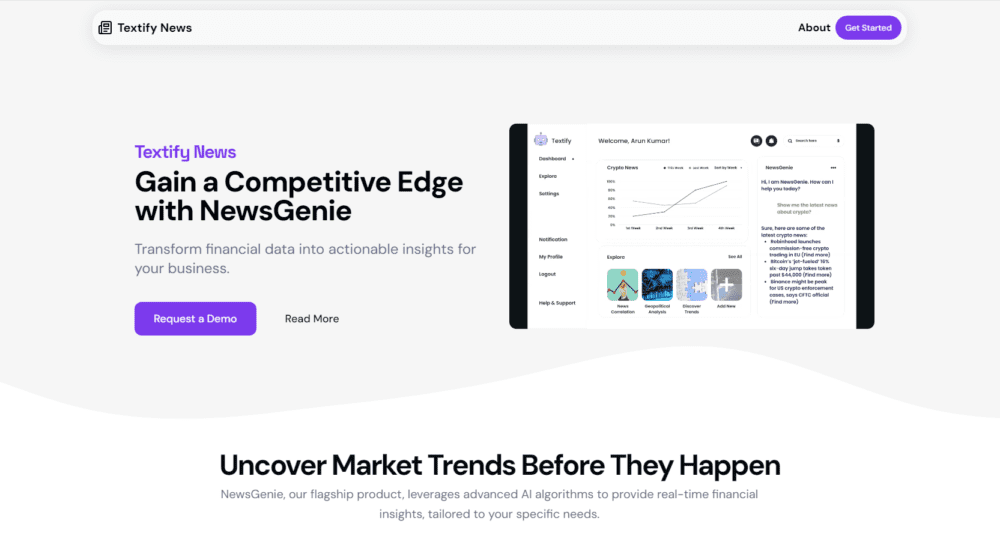

Staying informed in the financial world is no longer about scanning endless reports or waiting for the latest market updates. AI-powered financial news analysis, often driven by intelligent AI agents, has transformed how professionals interpret and act on information. With the ability to process vast amounts of data in real-time, AI tools like NewsGenie ensure that traders, analysts, and investors never miss a critical development.

By leveraging AI, businesses and financial experts can identify trends, filter out noise, and make data-backed decisions at an unprecedented pace. Instead of manually sifting through reports, AI-powered platforms extract key insights, summarize news, and predict potential market shifts—all in seconds. In much the same way, AI-driven analytics are revolutionizing other industries, including casino gaming, where real-time data enhances player experiences and engagement—read more about how advanced technology is shaping the future of online gaming.

How AI Transforms Financial News Analysis

AI is revolutionizing the way financial news is processed, delivering actionable insights faster than ever before. Traditional financial analysis relied on human experts spending hours interpreting stock trends, earnings reports, and market movements. Today, AI-driven solutions like NewsGenie automate this process, scanning thousands of news sources, social media updates, and financial statements in real time.

One of the primary advantages of AI-powered news analysis is its ability to detect sentiment and contextual relevance. By using Natural Language Processing (NLP), AI can differentiate between impactful news and irrelevant noise, providing users with only the most crucial information. This is particularly valuable in volatile markets, where quick, well-informed decisions can mean the difference between profit and loss.

Additionally, AI tools are not just about speed—they enhance accuracy. Human bias, fatigue, and information overload can lead to misinterpretations, whereas AI processes vast datasets with consistent precision. As AI continues to evolve, it becomes an essential tool for financial professionals aiming to stay ahead of the market.

AI-Powered News Filtering: Cutting Through the Noise

Financial markets generate an overwhelming amount of information daily. From government policies and corporate earnings to global economic shifts, the challenge is identifying which news matters most. AI-driven platforms address this by filtering out unnecessary data and focusing on relevant trends.

By analyzing historical data and market patterns, AI identifies correlations that might go unnoticed by human analysts. It assesses not just what is being reported but how it affects different sectors, assets, or currencies. This means traders and investors can react faster to market shifts rather than spending hours piecing together insights manually.

For instance, if an AI system detects a sudden increase in negative sentiment around a major corporation, it can alert investors before the broader market reacts. This proactive approach helps professionals make strategic moves rather than reacting to news after it has already influenced the market.

AI also ensures that users are not overwhelmed with redundant or misleading information. By refining search algorithms and improving relevancy scores, platforms like NewsGenie ensure that professionals get only the most impactful updates.

Enhancing Decision-Making with Predictive Analytics

Beyond filtering news, AI excels in predictive analytics, helping businesses anticipate market trends before they fully unfold. By analyzing historical data, AI can recognize patterns and generate forecasts that inform investment strategies.

For example, if past trends indicate that a specific stock tends to rise in response to certain economic reports, AI can highlight this correlation and suggest potential opportunities. This ability to anticipate market behavior gives professionals an edge, allowing them to position themselves strategically rather than simply reacting to events.

Predictive analytics also minimizes risk by identifying warning signs before they become crises. Whether it’s detecting early indicators of a financial downturn or forecasting the impact of new regulations, AI equips professionals with data-driven insights that mitigate uncertainty.

The Future of AI in Financial News Analysis

The integration of AI into financial news analysis is still evolving, but its impact is already profound. As machine learning models improve, AI Development Company India solutions will offer even more precise market predictions, enhanced risk assessment, and deeper sentiment analysis.

In the near future, AI-driven financial analysis could become even more personalized, tailoring insights to individual investment styles and risk tolerances. Instead of providing generic updates, AI will refine its recommendations based on a user’s past trading behavior, preferences, and goals.

Moreover, advancements in AI-powered automation will continue streamlining workflows for financial professionals. From summarizing earnings calls to generating instant reports on breaking news, AI will reduce the time spent on manual research, allowing experts to focus on strategic decision-making.

Conclusion

AI-driven financial news analysis is no longer a luxury—it’s a necessity for those looking to stay ahead in fast-moving markets. With tools like NewsGenie, professionals can filter relevant information, predict market trends, and make faster, smarter decisions. By leveraging AI’s real-time capabilities, businesses and investors can gain a competitive edge, ensuring they react to market changes before the competition.

As AI continues to shape the financial industry, its role in news analysis will only expand. The ability to process massive datasets, detect sentiment, and forecast trends makes AI an invaluable tool for anyone looking to navigate the complexities of the financial world with confidence.

Explore Textify’s AI membership

Be updated with Textify News

Need a Chart? Explore the world’s largest Charts database