Estonia is rapidly becoming a top spot for global e-commerce. The country boasts world-class IT skills, leading to the development of many e-commerce applications. Estonia also excels in areas like online trust, payments, and digital logistics, making it a perfect place to start your e-commerce business.

One big advantage of setting up an e-commerce business in Estonia is the easy access to over 500 million consumers from both the EU and non-EU countries. Estonia’s digital infrastructure is among the best, ranking #1 in Europe for electronic ID and cyber security. Almost all financial transactions in Estonia (99%) are done digitally, highlighting the country’s tech-savvy nature.

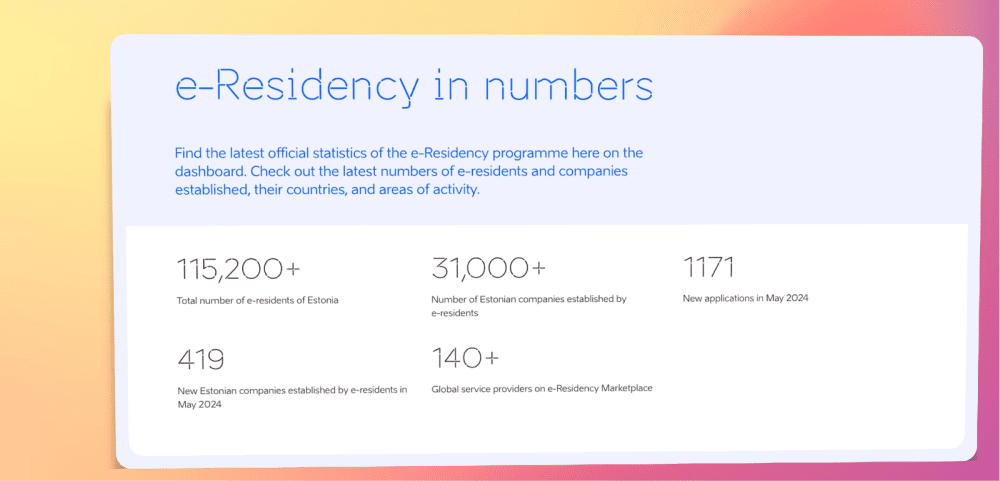

Estonia is also ranked #6 in Europe for ease of doing business, showing its friendly environment for businesses. The country’s e-Residency program is very popular, with over 115,200 e-residents who have started more than 31,000 Estonian companies. In May 2024 alone, there were 1,171 new e-residency applications and 419 new companies started by e-residents.

The e-Residency Marketplace includes over 140 global service providers, making it easy for e-residents to find the tools and services they need. With such strong support, Estonia offers a smooth and efficient process for starting and running an e-commerce business.

Taxes in Estonia

Estonia offers great tax benefits for businesses, especially for e-commerce. One major advantage is the 0% corporate tax on profits that are not distributed. This means if you reinvest your profits back into your business and don’t pay them out as dividends, you won’t pay any corporate tax. This policy helps businesses grow without the worry of immediate taxes. Estonia’s tax system is also simple and clear, making it easy for businesses to manage their taxes. These benefits make Estonia a great place for entrepreneurs who want to grow their business and save on taxes.

Accounting Duties for E-commerce Owners in Estonia

As an e-commerce owner in Estonia, you need to manage several key accounting responsibilities to ensure your business operates smoothly and complies with local regulations:

Bookkeeping services

Maintain accurate records of all financial transactions and business proposals, including sales, expenses, and purchases. Instead of relying on Excel entries, opt for fully automated accounting software like SimplBooks. This choice not only saves you time but also enables you to focus on expanding your brand effectively.

VAT Reporting and VAT thresholds

Register for VAT if your annual turnover exceeds the threshold (typically €40,000 – but this is a general rule and in most cases it doesn’t work.

When companies sell goods or digital services directly to consumers (B2C) or non-VAT registered companies within EU countries, and the annual sales do not exceed €10,000 per calendar year, they have two options for handling Value Added Tax (VAT):

- Register for VAT in each EU country where their customers are located and manage tax payments separately for each country.

- Opt for the OSS (One-Stop Shop) or IOSS (Import One-Stop Shop) special regimes in their home country. This allows them to declare and pay VAT for all EU sales in one consolidated return.

Choosing the OSS/IOSS VAT schemes is optional, yet it offers several advantages:

- Time savings: No lengthy delays waiting for VAT registration numbers from multiple countries.

- Cost efficiency: Only one VAT registration and tax declaration are required, reducing administrative expenses.

- Simplified procedures: Eliminates the need to interact with and submit paperwork to various EU tax authorities.

Managing VAT compliance efficiently is crucial for e-commerce businesses operating across EU borders, ensuring smooth operations and compliance with tax regulations.

File Annual Reports on time

Annual Financial Statements: Prepare and submit annual financial statements, including balance sheets and profit and loss statements, to the Estonian Commercial Register. The deadline for submission is June 30th each year. Failure to meet these requirements may result in penalties for the company.

Corporate Income Tax Reporting

Report profits and pay taxes on distributed dividends, if applicable, and file corporate income tax returns as necessary. Remember, if you choose not to distribute dividends, you can benefit from a 0% Corporation Tax rate on retained profits.

Checklist for Ecommece from zero to hero

STEP 1: Register your company in Estonia

Obtain e-Residency card or Register a company in Estonia through a notary public.

STEP 2: Purchase a .EE domain

Reserve .EE domain from Zone or other service provider.

STEP 3: Set up your e-commerce platform

Choose and launch a ready-made solution (e.g., Woocommerce, Prestashop, or other)

STEP 4: Populate your store

Add products with detailed descriptions and what is more important implement e-commerce conversion optimization strategies

STEP 5: Promote your e-commerce business

Develop and implement marketing strategies. Consider SEO, social media, and Google Ads

Conclusion

In conclusion, registering an e-commerce business in Estonia proves highly advantageous. With the ability to manage operations remotely through the e-Residency card, investors can capitalize on a 0% Corporation Tax rate on retained profits. Moreover, Estonia’s supportive startup ecosystem fosters collaboration among emerging businesses, enhancing opportunities for growth and innovation. These combined benefits make Estonia a compelling choice for entrepreneurs aiming to establish and expand their e-commerce ventures seamlessly.

Paweł Krok

Board Member at Eesti Consulting OÜ

Pawel Krok is a board member at Eesti Consulting OÜ, a consulting company that focuses specifically on company registration in Estonia. He helps entrepreneurs with first steps on the Estonian Market. He was an expert in the World Bank’s Business Ready 2023 Project.

Check out more AI tool.

Elevate Guest Experience with RoomGenie

🚀 Check out NewsGenie – Your AI consultant